The house shown here, located at 4448 Athlone Avenue in the O'Fallon neighborhood, is just one of the 225 vacant properties purchased by a holding company named Urban Assets LLC in the last six months. The spending spree has attracted the notice of neighborhood leaders and elected officials across north St. Louis. Urban Assets has purchased across a wide swath of north St. Louis, mostly between Delmar Boulevard on the south and Natural Bridge Avenue on the north -- all of the way from Grand Avenue on the east to the city limits on the west.

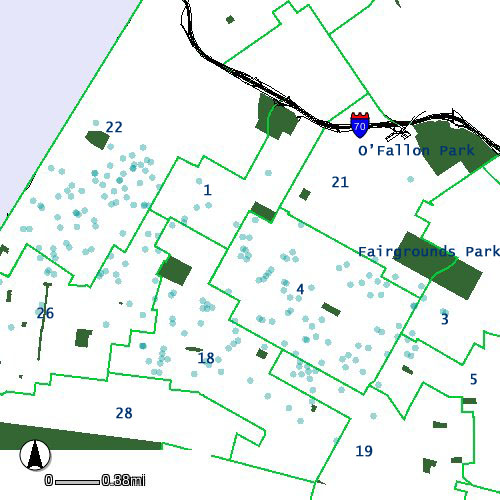

Here is a crude map of the holdings made by this writer using Geo St. Louis:

The holdings are spread across nine wards and include 120 vacant lots and 85 buildings, mostly historic. The wards and number of properties are as follows: Ward 1 (7), Ward 3 (4), Ward 4 (64), Ward 5 (5), Ward 18 (39), Ward 19 (11), Ward 21 (4), Ward 22 (64) and Ward 26 (27).

There are distinct concentrations in the Ville and Greater Ville neighborhoods as well as the Wells-Goodfellow and Hamilton Heights neighborhoods. There are a handful, like 4448 Athlone, standing alone far from other holdings. Urban Assets began aggressively purchasing properties at Sheriff's tax sales in September 2008. Most of the holdings come from tax sale purchasing, with prices often less than $2,000 at auctions with no other bidders.

This purchase pattern is reminiscent of the start of purchasing by McEagle holding companies like the infamous Blairmont Associates LC -- and the same real estate broker is making the purchases for the parties behind the holding company.

On June 6, 2008, real estate broker Harvey Noble of Eagle Realty incorporated Urban Assets LLC online. The incorporation filing and the registered agent listing on the Secretary of State's website misspell Noble's name as "Nobel" and incorrectly state that the zip code for Noble's office is 63102.

On the record with KWMU and the St. Louis Post-Dispatch, Paul J. McKee, Jr. denies any involvement with Urban Assets. Examining the acquisition patterns of Urban Assets, one sees that there is no overlap with the McEagle project and a few intense concentrations that suggest efforts to buy out other areas. Whoever is behind Urban Assets could very well soon be in competition with McEagle for the Distressed Areas Land Assemblage Tax Credit Act.

While Urban Assets seems to be buying whatever it can acquire in certain small areas, generally the company seems interested in vacant property in as much of north St. Louis as possible. The acquisitions almost seem like a private land bank like the city's Land Reutilization Authority.

The only apparent incentive to this type of far-flung land banking, however, is the Distressed Areas Land Assemblage Tax Credit. In order to receive that credit, a developer must be appointed redeveloper by the Board of Aldermen. Redevelopment rights don't necessarily mean that a developer will clear-cut a redevelopment area. Those rights fundamentally mean that a developer acts as gatekeeper for all investment within a redevelopment area -- allowing some in and keeping others out.

Is Urban Assets seeking to become a gatekeeper for north St. Louis, or is their acquisition simply a land-banking scheme?

2 comments:

It stinks and sounds like that rascal Mckee. He is bad for St. Louis in my opinion.

Hopefully, the St. Louis historical society will get some outside national help. The local elected officials in the St. Louis are not that useful in my opinion. The local elected officials fail to realize that they are here to serve the wishes of the citizens that put them in office.

Hmmm, this looks to me like a 4-lane highway heading from Page through to the new bridge.

Post a Comment